Plum, India’s leading insurtech company providing employee health & wellness solutions to over 3,000 corporations, is taking a significant leap forward by expanding its offerings to cover businesses insurance with the launch of Plum Business. Plum's expansion into business insurance represents a notable milestone in the company's journey. This is the third line of business that Plum has launched after Employee Insurance and Employee Health Benefits.

Founded in 2019, Plum is Contribution Margin positive with a 3X year-on-year growth. Building on this momentum, Plum will now offer curated and customizable business insurance products, aiming to empower businesses to thrive in an increasingly complex and challenging landscape.

Abhishek Poddar, co-founder and CEO of Plum, said, “The financial well-being of a business is directly proportional to the financial well-being of its employees. Today, businesses are prone to various risks—Financial, Operational, Legal, People and Governance related —yet unfortunately, many remain uninsured. With Plum Business, we aim to create a sustainable ecosystem that safeguards both. We have brought the conversation of 'benefits' and 'wellness' to the spotlight, and we will continue to consult companies on the best and most evolved benefits solutions while driving our existing business forward.”

“With this new business foray, we expect to turn profitable by FY 2025,” Poddar added.

The decision to venture into the business insurance space comes at a crucial time when startups and businesses face multiple challenges around corporate governance. Plum recognizes the need for businesses to prioritize revenue, sustainability and risk management. By providing comprehensive business insurance coverage, Plum enables businesses to protect their people, profits, and runways while instilling trust and confidence in stakeholders.

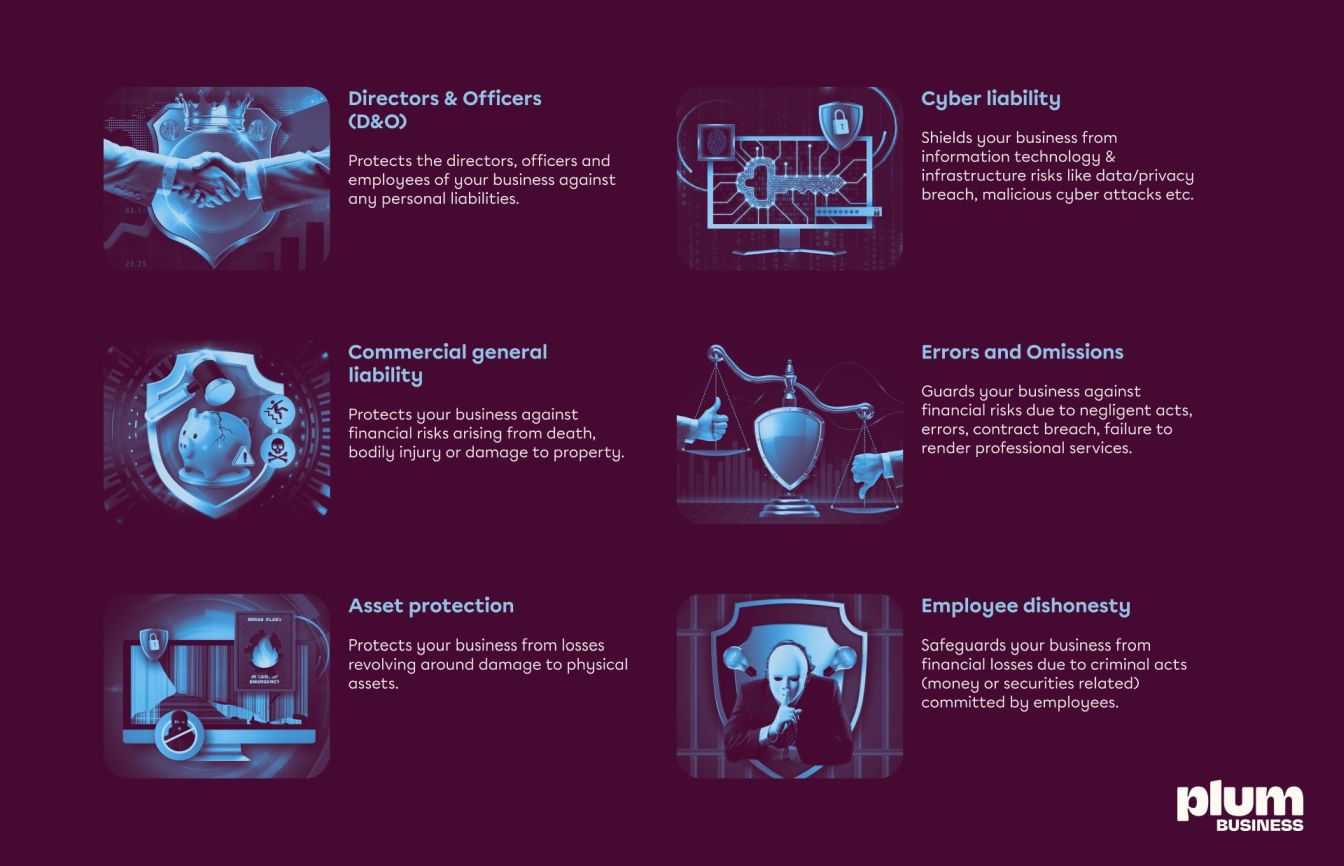

Plum will offer the following products under Plum Business.

Aditya Bagarka, Head of Strategy and Innovation at Plum, said, “At Plum, we do not believe in selling products in silos. We are designing holistic solutions for organizations based on their growth journey and risk appetite, understanding that risks in the business landscape are constantly evolving. We help customers in designing their bespoke insurance programs that evolve as they grow and enable them to build their businesses better by guiding them in transferring and mitigating risks effectively.”

Businesses find themselves involved in litigation a lot more than before, and this means mounting legal expenses. The increasing number of complex legal cases and rising litigation costs in India, which amount to 0.5 to 0.7% of the country's GDP, highlight the need for businesses to address insurable risks. Industries such as IT/ITeS, EdTech, Fintech, and any growth stage startup have been identified as having the highest requirements for business insurance, and Plum is prepared to cater to their needs.

With its commitment to providing exceptional and holistic insurance solutions and its track record of steady growth, Plum is well-positioned to guide businesses toward long-term viability and success.