NeoGrowth delivers on six United Nations Social Development Goals (UNSDGs)

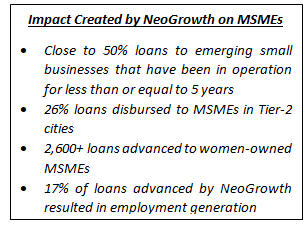

Women-run small and medium enterprise (MSME) customers availed INR 430 crore worth of loans accounting for a significant portion (24%) of overall loans (total disbursals of close to INR 1,900 Cr. in FY 2023) disbursed to MSMEs, according to the NeoGrowth Impact Report 2023. The report stated that more than 2600+ women-owned MSMEs availed business loans in the last fiscal year. NeoGrowth is an MSME-focused digital lender in India, leveraging the digital ecosystem.

Released annually, the 9th edition of the NeoGrowth Impact Report showcases the transformative influence of the Company’s loans on the lives of MSME borrowers, alongside its commitment to sustainable business practices, digital integration, and fostering an inclusive credit ecosystem while maintaining the highest level of governance. The data covered in the report pertains to FY 2022-23.

Achieving UN’s Social Development Goals

NeoGrowth’s approach to lending is centred on creating a positive impact by setting a distinctive standard for financial inclusion in India. Importantly, NeoGrowth’s business activities are aligned to 6 out of 17 United Nations SDGs and it is constantly working towards holistically contributing towards them. NeoGrowth has delivered on key UN SDGs including Good Health and Well-being; Gender Equality; Industry, Innovation and Infrastructure; Decent Work and Economic Growth in terms of value and volume.

The 17 social development goals are the key objectives set by the United Nations in 2015 towards sustainable development and were created to serve as a “shared blueprint for peace and prosperity for people and the planet now and into the future”.

The company disbursed close to INR 500 Crore to MSMEs in Tier-II cities. Almost 50% of the total loans were advanced to emerging small businesses that have been in operation for less than or equal to 5 years.

Based on an impact survey conducted with over 250 NeoGrowth customers across 7 cities, 84% of respondents were self-starters, who were the first in their families to establish a business. The interviewed MSME owners witnessed an 18% increase in female employees post availing a business loan from NeoGrowth. Almost 1/4th of the MSMEs expanded their business with the loan.

“At NeoGrowth, we are not only building a sustainable, inclusive and purposeful ecosystem for MSMEs in India to bridge the credit gap but also achieving six important social development goals set by the United Nations, thereby contributing towards holistic growth. All our customers come with unique business stories, and we are proud to be associated with small business owners from over 75 industry segments. It is our unwavering commitment to empower first-generation entrepreneurs, support women-run businesses, and promote financial inclusion, thereby contributing to a thriving and inclusive economy. MSMEs are driving the growth of India’s economy and will continue to spearhead the realisation of India’s USD 5 trillion economy vision,” said Arun Nayyar, Managing Director & CEO of NeoGrowth.

The loans extended by NeoGrowth also have a snowball effect on MSMEs, which includes job creation, improvement in credit score, female entrepreneurship, and digitalisation of MSMEs, among others.

The Company crossed the INR 2,000 Crore Assets Under Management (AUM) mark as on June 30, 2023, at the end of the first quarter of FY 2023-24. Present in 25+ cities and catering to 75+ MSME industry segments, NeoGrowth has disbursed over USD 1 Billion since its inception.

Read the complete report here: https://www.neogrowth.in/social-impact/