The Confederation of Real Estate Developers' Associations of India (CREDAI) along with its knowledge partner Cushman & Wakefield, today released a report “India’s Next 10 Emerging Markets: Engines for future growth of Commercial Real Estate” at the 21st NATCON in Egypt.

The report comprehensively puts forth real estate sector’s next growth mile, identifying 17 cities across India on the basis of healthy traction in overall real estate development, organised retail penetration, and mature residential market development. Of these cities, Bhubaneswar, Coimbatore, Indore, Jaipur, Kochi, Lucknow, Nagpur, Surat, Thiruvananthapuram Visakhapatnam have been identified as the 10 emerging cities that hold the highest potential for growth in the foreseeable future.

While Delhi NCR, Mumbai, Bengaluru, Pune, Hyderabad, Chennai, Kolkata, and Ahmedabad continue to be the key 8 real estate markets, the report anticipates that these 10 tier-II are soon going to add more power to the India-growth-story, propelling the nation's development forward. The cities have been selected based on indicators pertaining to population, infrastructure, talent pool, income, ease of living, and housing affordability.

The report highlights how rising urbanization is putting pressure on the existing infrastructure across the tier-I cities as they try to fulfil the growing demand for quality-built spaces. The country is urbanizing swiftly with the urbanizing rate rising by 32% in 2013 to ~36% in 2023 and this is shifting the focus towards markets that have the advantages and development potential to be the next promising destination for the real estate sector.

Rising incomes and consumption levels have made tier-II cities a magnet for retail investments. As large Grade-A malls and prominent highstreets are getting developed, India’s tier-II cities are evolving into major consumption hubs, a trend that is likely to gain momentum in the coming years. The residential sector has also witnessed significant growth in many of these cities and they perform well on affordability parameter.

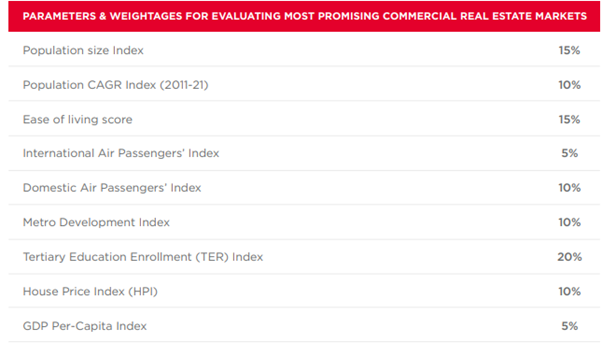

The report takes into consideration parameters like population, economic prowess and potential attractiveness of the cities from commercial real estate to identify the emerging cities. Moreover, parameters such as tertiary education enrolment, population size, and ease of living have been assigned highest weights compared to others as these are largely the foremost reasons for corporates to move their office base to a new location. In aggregate, the report focused on infrastructure and connectivity as parameters that are important drivers of commercial activity today.

The study also considered the Metro Development Index data that combines operational metro routes (in KMs) as well as under-construction and proposed metro routes. Other indicators include the population growth (for the latest census decadal period), house prices (to measure affordability across quality Grade-A projects) and GDP per-capita (to measure consumption potential or discretionary spending), all of which potentially offering a 360-degree view of the real estate market development potential across the selected tier-II cities.

Fig 1 – WEIGHTAGE OF EACH EVALUATION PARAMETER

While unveiling the report, Boman R Irani, President CREDAI said, “As India continues its remarkable journey of economic growth and witnesses higher rate of urbanization, we anticipate newer cities to fuel the future growth of the commercial real estate market. We believe this report will prove to be invaluable not only for corporate occupiers exploring alternative locations beyond the top 8 real estate markets but will also provide insights to developers on the kind of opportunities that exist in their own domains”.

Speaking of the report, Anshul Jain, Head of APAC Tenant Representation and Managing Director, India & South East Asia, said, “The report shares invaluable insights on the country’s growth story with the real estate industry as one of the key drivers. We are estimated to be the fastest growing major economy and are on course to become a USD 5.0 trillion economy by FY2026-27. But to fulfill our ambition, it is increasingly becoming evident that we need to further accelerate our pace of economic growth and create more metros. It is India’s tier-2 cities that are going to significantly contribute to the nation-building narrative. With this report, we aim to spotlight the potential of the top 10 emerging cities”

You can get full access to the report here